Algo Tradingの革新:Grotuxivがもたらす新時代 近年、金融市場の進化とともに、アルゴリズムトレーディング(Algo Trading)はますます注目を集めています。投資家やトレーダーたちは、より精度の高い自動売買システムを求めて新しいテクノロジーを取り入れています。その中で特に話題となっているのが、Grotuxivです。Grotuxivは、効率的かつ革新的なアルゴリズムを搭載し、これまでにないトレーディング体験を提供します。この記事では、Grotuxivの特徴やメリット、そして日本の投資家にとっての活用方法について詳しくご紹介します。最先端の自動売買ツールに興味のある方は、公式サイトもぜひご覧ください。 Grotuxivとは?日本市場で注目される理由とその魅力 Grotuxivは、アルゴリズムトレーディングの分野で急速に認知度を高めている自動売買システムです。従来のトレード手法では人間の感情や判断ミスが大きなリスクとなっていましたが、Grotuxivは高度なAIアルゴリズムを駆使し、マーケットの変動をリアルタイムで分析します。これにより、最適な売買タイミングを自動で判断し、利益の最大化を目指します。 Grotuxivの最大の特徴は、その高いカスタマイズ性にあります。ユーザーは自身の投資スタイルやリスク許容度に合わせて、戦略のパラメータを細かく設定できます。これにより、初心者から上級者まで幅広い投資家に対応した柔軟な運用が可能となっています。さらに、こちらから提供される豊富なドキュメントやサポート体制により、初めてAlgo Tradingに挑戦する方でも安心して始められます。 また、Grotuxivは日本の金融市場にも最適化されており、国内の証券会社との連携もスムーズです。リアルタイムでのデータ取得や自動発注機能など、国内投資家のニーズに応える機能が充実しています。これにより、Grotuxivは日本市場においても急速に支持を集めています。 セキュリティ面でもGrotuxivは高い評価を受けており、ユーザーデータの暗号化や二段階認証など、安心して取引できる環境を提供しています。さらに、アルゴリズムのアップデートも頻繁に行われており、常に最新の市場状況に対応できる点も大きな魅力です。 もし、効率的かつ安全なアルゴリズムトレーディングを始めたいと考えているなら、今こそGrotuxivで新しいトレード体験を始める絶好のタイミングです。最新情報や導入方法についてはこちらの公式サイトで詳しくご確認ください。 Grotuxiv Grotuxiv

Algo Trading: La Nuova Frontiera con Quantum AI L’algo trading sta rivoluzionando il modo in cui gli investitori affrontano i mercati finanziari. Grazie all’automazione e all’analisi avanzata dei dati, è possibile ottenere risultati impensabili fino a pochi anni fa. Tra le soluzioni più innovative spicca Quantum AI, una piattaforma che fonde intelligenza artificiale e tecnologia […]

Algo Tradingの最前線:Leztruvinが切り拓く未来 近年、金融市場における自動取引(アルゴリズムトレーディング)は、個人投資家からプロのトレーダーまで幅広い層に注目されています。複雑な市場分析や迅速な取引執行を自動化することで、効率的な運用と新たな投資戦略の可能性が広がっています。その中でも、Leztruvinは革新的なプラットフォームとして注目を集めています。本記事では、Leztruvinの特徴や利点、そして日本の投資家にとってのメリットについて詳しく解説します。アルゴトレードの新時代を切り拓くLeztruvinの全貌を、ぜひ公式サイトとともにご覧ください。 Leztruvinとは?―アルゴリズムトレーディングを変革する最新ツール Leztruvinは、先進的なアルゴリズムトレーディングを誰もが簡単に利用できるように設計されたプラットフォームです。従来、アルゴトレードは高度なプログラミング知識や専門的な金融知識が必要とされてきました。しかし、Leztruvinは直感的なインターフェースと強力な自動化機能を組み合わせることで、初心者から経験豊富なトレーダーまで幅広いユーザーに最適な環境を提供します。 最大の特徴は、AIを活用した高度な分析エンジンです。Leztruvinはリアルタイムで市場データを解析し、最適な売買タイミングを自動的に判断します。これにより、感情に左右されず、客観的かつ効率的な取引が実現可能となります。さらに、Leztruvinのプラットフォームは、複数の戦略テンプレートを搭載しており、ユーザーは自身のリスク許容度や投資スタイルに合わせてカスタマイズが可能です。 セキュリティ面でもLeztruvinは高く評価されています。ユーザー資産の保護や個人情報の管理に最新の暗号化技術を採用し、安心して取引を行うことができます。また、24時間365日のサポート体制も整っており、トラブル時も迅速に対応してくれます。 日本市場に特化したサポートや日本語インターフェースも充実しており、国内の投資家にとって非常に使いやすい環境が整っています。デモ取引機能も搭載されているため、初めての方でもリスクなくアルゴトレードを体験できます。こちらからLeztruvinについて詳しく知ることで、最先端の自動取引を今すぐ始めることができます。 これからの資産運用において、アルゴリズムトレーディングはますます重要性を増していくでしょう。Leztruvinは、時代の最先端を行くツールとして、投資家一人ひとりの可能性を広げます。興味のある方は、Leztruvin公式サイトで最新情報や利用方法をチェックしてみてください。 Leztruvin

Algo Trading: Innovación y Oportunidades en el Mercado Financiero El algo trading ha revolucionado la forma en que operan los mercados financieros en España y el mundo. Gracias al avance de la tecnología, cada vez más inversores buscan automatizar sus estrategias para maximizar beneficios y minimizar riesgos. El uso de algoritmos permite ejecutar operaciones a […]

Algo Trading: Innovazione e Opportunità nel Mercato Finanziario L’algo trading sta rivoluzionando il modo in cui gli investitori e i trader operano sui mercati finanziari. Grazie all’utilizzo di algoritmi sofisticati, oggi è possibile automatizzare strategie di trading, riducendo l’errore umano e sfruttando tempestivamente le opportunità di mercato. In Italia, sempre più professionisti e appassionati stanno […]

Algo Trading: The Future of Automated Investments Algorithmic trading, or “algo trading,” is revolutionizing the way investors approach the financial markets. By leveraging advanced algorithms and real-time data, traders can execute orders at lightning speed and with unmatched precision. This modern approach minimizes human error, maximizes efficiency, and opens up new opportunities for both novice […]

Algo Trading Revolution: Harnessing the Power of Xonata AI The world of algorithmic trading is evolving at lightning speed, and staying ahead means leveraging the latest advancements in artificial intelligence. Enter Xonata AI—a cutting-edge solution designed to transform how traders analyze, predict, and execute trades. Whether you’re a seasoned investor or just starting your journey, […]

Casino Thrills Await: Dive into Bonanza Megaways Slot NZ The world of online casinos is constantly evolving, offering players in New Zealand ever more exciting ways to enjoy their favourite games. Among the most popular choices is the innovative Bonanza Megaways Slot, a game that has captured the imagination of slot enthusiasts across the country. […]

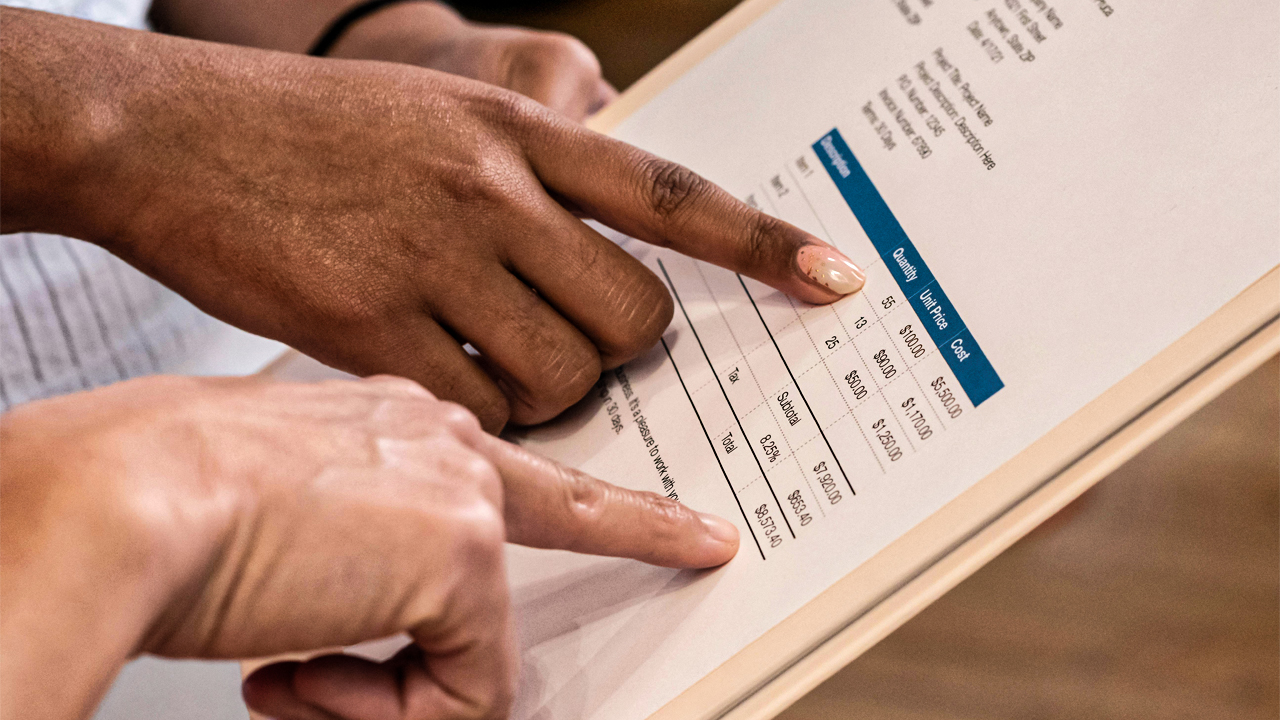

The UAE has taken another major step toward modernizing its tax and business ecosystem. The Ministry of Finance has officially issued comprehensive electronic invoicing guidelines, setting the stage for a nationwide rollout that will gradually transform how businesses issue and manage invoices across the country. According to a recent report by Gulf News, the new […]

Dubai is recognized globally as a thriving business and financial hub, attracting investors, entrepreneurs, and expatriates from all over the world. With opportunities ranging from real estate investments to global equities and startups, the potential for financial growth is enormous. However, the complexity of the market, combined with international tax regulations and changing financial landscapes, […]